For the insurance industry, Artificial Intelligence (AI) can prompt mixed emotions: excitement, concern, and confusion. This is especially true when we discuss AI’s impact on customer interactions, risk assessment, and overall business operations. In his recent article in Demotech Magazine, Mark Breading, Senior Partner at ReSource Pro, identifies three areas for carriers to focus on. These include the current state of AI, effective use cases, and governance strategies.

While Generative AI (GenAI) specifically has received the most attention recently, AI isn’t new to the insurance sector. Insurers have been using AI technologies for years, from machine learning and natural language processing to RPA. In his article, Mark discusses the importance of exploring these technologies from a business perspective. Understanding how insurers are currently using AI provides better insight into the potential areas for growth and improvement.

AI Use Cases in P&C Insurance

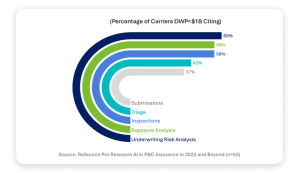

- Risk analysis: Underwriting risk analysis is currently the most common application of AI for carriers. Personal and commercial lines often differ in their approach to AI augmentation, especially with regards to human touch.

- Claims: Many insurers are already using AI-based solutions for fraud detection, predictive reserving, and triage.

- No shortage of applications: Carriers can benefit from AI in a variety of ways. The key is to identify, prioritize, and govern AI use cases to maximize their potential.

AI Governance Challenges

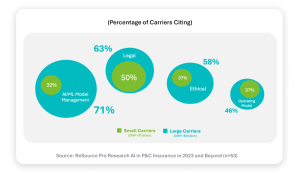

- GenAI: Experts have long discussed the importance of effective AI governance in the insurance space. However, the arrival of GenAI brings additional legal, ethical, and regulatory concerns.

- Key issues to address: Insurers are working to find solutions for a range of issues, including model management, potential bias, privacy issues, and fraud.

- Different carriers, different challenges: Large carriers face different governance challenges compared to smaller carriers, but also tend to have more resources and experience. Across the board, in the short term, insurers are focusing on legal and regulatory issues posed by AI.

Practical Recommendations for Carriers

- Don’t let AI lead you: Focus on business needs and overall strategy before diving into AI implementation. Starting with technology and allowing it to inform your strategy can lead to wasted time and effort.

- Be curious and people-focused: Stay open to new ideas and experimentation and engage with people across the enterprise.

- Monitor industry trends: Be informed about AI usage within and outside the insurance industry.

- Remain agile: Be willing to pilot AI projects, fail fast, and pivot when needed. Once you have a plan in place, be ready to make quick decisions and move forward.

Interested in learning more about leveraging and governing AI in the insurance industry? Read Mark Breading’s full article on the subject, originally published by Demotech Magazine, here.