Insurers shift to omni-channel operations

Today, customer expectations have overwhelmingly shifted to digital. The number of people who want all communications via paper or voice is rapidly dwindling, as the majority of the population uses messaging platforms and social media every day and are adept at all manner of mobile and online interactions.

As a result, countless P&C insurers are investing in two interrelated strategic initiatives: customer experience and digital transformation. These strategies and investments involve a wide range of initiatives and projects aimed at enabling omni-channel operations and improving customer communications for marketing, sales, and service interactions.

Ultimately, the objective is to focus on digital engagement to meet customer expectations, strengthen relationships, and contribute to positive financial results through top-line growth and bottom-line profit.

What is digital engagement?

Digital engagement is broadly defined as any interaction activity that involves the use of technology-based tools (not face-to-face or paper) that help customers find information, communicate needs, request service, or interact with their company in other ways. These may include exchanges via email, chat, SMS text message, websites, social media, and other communications that are transferred in digital formats.

From reactive to proactive engagement

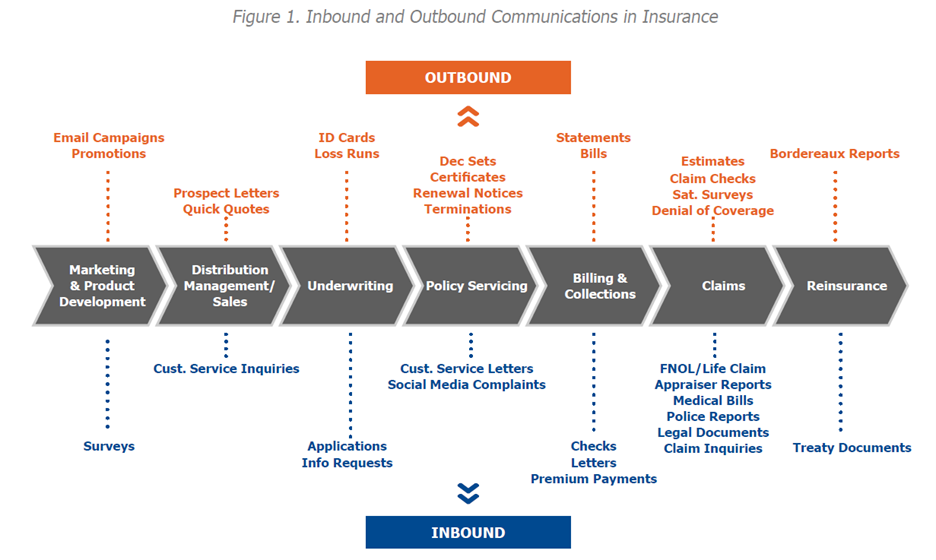

Historically, most inbound and outbound communication between insurers, agents, and policyholders has been carried out via paper, phone conversations, agent/insured portals, or in-person meetings. And much of the communication from the insurer to the customer has been reactive—triggered by inbound customer requests, mandatory regulations, and timelines that are internally focused (for example, renewal dates or payment reminders).

This often makes it a one-way conversation, or in the case of a customer request, a customer service-oriented task with operational efficiency the top priority.

There is new potential to shift the paradigm over to a proactive and digital two-way conversation that generates true engagement. Virtually all of the interactions shown in Figure 1 can be conducted via digital means, which positions insurers to be more timely, more personalized, and more interactive. In addition, new types of communications can be added to the mix, especially those leveraging social media and messaging platforms.

Proactive digital engagement keeps conversations going and drives outcomes of improved customer experience that contribute directly to increased retention, reduced costs, and operational efficiencies.

Use case: transforming delinquent billing outcomes

A major P&C carrier targeted the use of proactive digital engagement to reduce policyholder churn caused by billing delinquencies. With paper notifications often lost or discarded, they wanted to find an effective way to engage clients through their nationwide captive agency force.

The insurer ran a three-month pilot, sending personalized automated texts to delinquent customers and following up a few days later with a phone call, creating a new level of proactive digital engagement.

Over 1,000 delinquent policies were processed with very strong results:

- High engagement rates — 20% of customers entered into a text conversation

- Low opt-out rates — less than 2% of customers opted out

- High retention rates — a large majority of delinquent customers were retained

- Less manual work — results were achieved with 50% fewer outbound calls

A hybrid approach will bring the greatest value

Reactive communications will be a requirement for as long as we have traditional insurance transactions and touchpoints. They can be digitized and become more real-time, but they will remain. Proactive communications will layer in new communication methods that bring higher value to the customer as well as better business outcomes. Ultimately, the usage of both reactive and proactive will be necessary, relying on the intelligent use of the right format and channel based on customer journeys and preferences, and subject to regulatory requirements.

Visit our Carrier Consulting page for more information about our research, consulting, and advisory services.