Rob serves as Principal, Solutions Architect and Sandeep serves as Senior Director, Integrated Solutions at ReSource Pro

Address Operational Challenges with a Problem-Solving Framework and Mindset

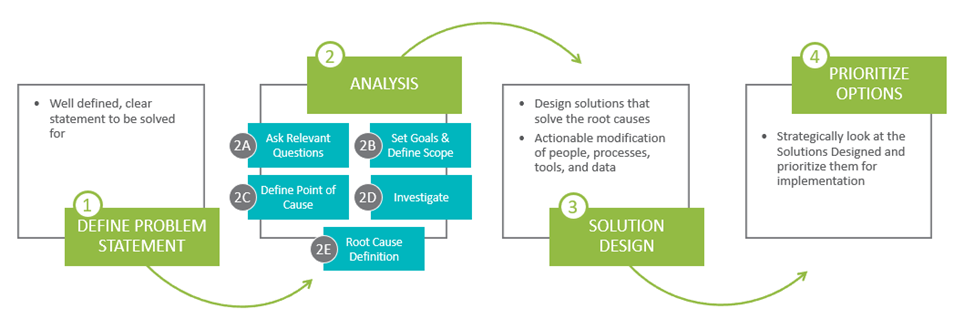

Think about big initiatives, goals, and challenges that your organization is facing right now. Most likely, they aren’t siloed within one department or easily solved with one answer. Problem solving and solution creation is complex. You have to deal with multiple departments and a myriad of interwoven smaller challenges.

So, how do leading insurance organizations efficiently and effectively drive positive change? They use an appropriate framework that can be applied to any initiative, ensuring they are covering every aspect of the challenge. In this blog, we’ll outline a tried-and-tested framework that covers problem identification all the way through to identifying potential solutions.

To illustrate this framework, we’ll be using an example loosely based on an actual challenge faced by one of our clients. In our example, an insurance carrier, Carrier A, was receiving an increasing number of submissions, but wasn’t realizing the bind ratios they desired. Let’s dive into the problem-solving framework and how we helped Carrier A leverage it to address the challenge.

1. DEFINE A PROBLEM STATEMENT

It’s one thing to recognize that your organization is facing a problem, it’s another to clearly articulate the problem. To start, develop a 2–3 sentence statement which summarizes the challenge you are facing, as this will help you and those working with you to align and focus on the problem you are looking to solve.

In our example, we collaborated with Carrier A to define their problem statement as follows: “Our submission volume is continuing to grow. To support effective clearance, we keep hiring more people. However, our ratios (submit to bind, quote to bind) aren’t significantly improving.”

2. PERFORM ANALYSIS

2A) Ask relevant questions. Continue to build upon your problem statement by diving into the details. Ask yourself what data you can leverage to better understand the problem, which of that data is available and which is missing, and how you will measure your success. For example, Carrier A wanted to determine how much their volumes were increasing by and why, as well as what specific barriers were keeping them from being more efficient.

2B) Set goals and define scope. You can’t boil the ocean—define your scope and set goals that are realistic. Think about specific metrics you hope to achieve, in which part of the business, and within what timeline. Carrier A decided to set the following goals:

- We will improve individual capacity by 10% before the end of the year for our 3 main lines of business.

- We will focus on the “right” submissions that will help our business meet our strategic and financial goals and increase our quote to bind by 5%.

- We will clearly articulate our appetite for our top 3 lines of business and evaluate the effectiveness of our broker community

2C) Define point of cause. The “point of cause” refers to something that is contributing to the problem you are trying to solve. In some cases, the point of cause is external, and may be out of your control. In other cases, you can take steps to solve or mitigate it.

Carrier A determined that the hardening market, as well as brokers trying to block the carrier as a market for their competitors, were driving increased submission volume. To address this, the carrier chose to hold conversations with their brokers to better understand what was driving the high volume of submissions, as well as examine loss ratios by broker.

2D) Investigate. Continue your investigation with the “five whys” technique. Start with the top-level problem—in this case, a large volume of submissions—ask why, answer, then repeat until you have uncovered the root cause. Note that in some cases, you may need to ask more than five questions, in others, less.

- Question: Why are we struggling to keep up with the volume of our submissions?

Answer: Our people lack the capacity to keep up with volume

- Question: Why do our people lack the capacity to keep up with the volume?

Answer: Our systems and processes are not scalable

- Question: Why are our systems and processes not scalable?

Answer: Because we treat all our submissions equally

- Question: Why do we treat all our submissions equally?

Answer: We don’t prioritize our submissions

- Question: Why do we not prioritize our submissions?

Answer: We currently lack insights (and data) to prioritize

2E) Define the root cause. Just as you clearly defined the problem statement; you should do the same for the cause. Carrier A identified their root cause as follows: “Our systems and processes limit our capacity. We don’t understand our submission characteristics adequately to drive desired business outcomes. Our lack of insight into suitability of individual submissions inhibits our ability to prioritize them.”

3. DESIGN SOLUTIONS

Now that you have a clearly established the problem and root cause, you can begin designing a solution. Often, there will be multiple ways to approach the problem. Developing a detailed blueprint that addresses each root cause will enable you to understand the expected time and cost necessary to deploy the identified solutions, as well as appreciate the impact and feasibility therein.

Carrier A designed the following options:

- Data & Analytics Improvements – We will collect meaningfully data (not necessarily more) and layer on insightful analytics

- Efficiency Evaluation – We will evaluate our existing tools, processes, and people to make them as efficient as possible

- Submission Prioritization – We will prioritize the most important and impactful submissions for underwriting review

- Status Quo – Take no action

4. PRIORITIZE YOUR OPTIONS

As time and budget will typically prevent you from implementing all identified solutions, you should evaluate each option based on factors such as strategic importance (per your organization’s goals and priorities), investment needed, time required to implement, and time required to deliver positive, measurable results.

We recommend analyzing your solutions based on the following factors, using a weighted average to calculate the overall score adjust the weights per your specific situation), then ranking each:

- Strategic importance – Rank from 1–3, 3 being lowest. Weight 20%.

- Investment needed – Rank from 1–3, 3 being lowest. Weight 25%.

- Time to complete – Rank from 1–3, 3 being lowest. Weight 10%.

- Time required to recognize ROI – Rank from 1–3, 3 being lowest. Weight 20%.

- Post implementation net impact – Rank from 1–3, 3 being highest. Weight 25%.

Keep in mind that problem solving is rarely a “one and done” process. While one solution may not rank as high as another, you should still consider how it might benefit you in the future. You may even want to create a road map that includes each of the solutions you’d like to implement.

Below is an example of a prioritization matrix based on Carrier A’s designed solutions.

You Can Design Your Operations Solutions and Be Successful!

Gut instinct can go a long way in solving problems but will only take you so far. By leveraging a framework like the one in this blog, you can approach problem-solving more strategically and home in on the solutions that will benefit your organization the most.

If your insurance organization is struggling with a complex challenge and needs help, find out how ReSource Pro can optimize your operations.