Macroeconomic conditions are challenging for insurance companies in general, but they offer some opportunities for surplus lines companies. With inflation at a 40-year high, persistent supply chain issues, and continuing increases in claims costs, insurance rates are likely to remain high. These factors are driving more risks to the surplus lines market.

The Consumer Price Index increased 9.1% in June 2022, the highest 12-month hike since 1981, according to the U.S. Bureau of Labor Statistics. The CPI settled to 8.2% in September, and inflation is expected to reduce further by the end of 2023, according to economists at JPMorgan.

Social inflation, a term that reflects societal shifts in attitudes about litigation and court awards, is outpacing economic inflation, according to the Insurance Information Institute. An increase in outsize jury awards, so-called nuclear verdicts in the tens of millions of dollars, is expanding liability risks and increasing settlement costs. Although the non-admitted market has an opportunity to sell more liability coverage, social inflation also has a negative impact on insurers’ balance sheets. Adverse loss development from larger liability claims erodes reserves.

Rising claims costs and supply chain issues that are keeping some claims open longer add stress to insurers’ claims management processes.

The Non-admitted Market Is Growing

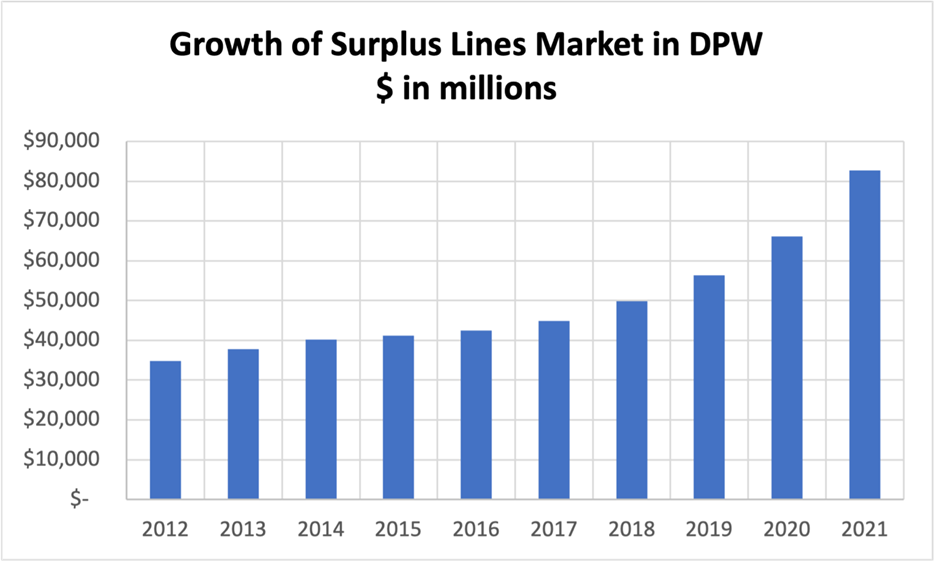

Despite the economic headwinds, non-admitted insurers have reported steady growth in direct written premium volume year over year. After a 17.5% increase in non-admitted DWP in 2020, premiums surged 25% in 2021, according to A.M. Best Company.

Source: A.M. Best Company

Growth in non-admitted premium volume is a strong indication of business flowing into surplus lines. This may continue for some time, until the overall insurance market begins to soften.

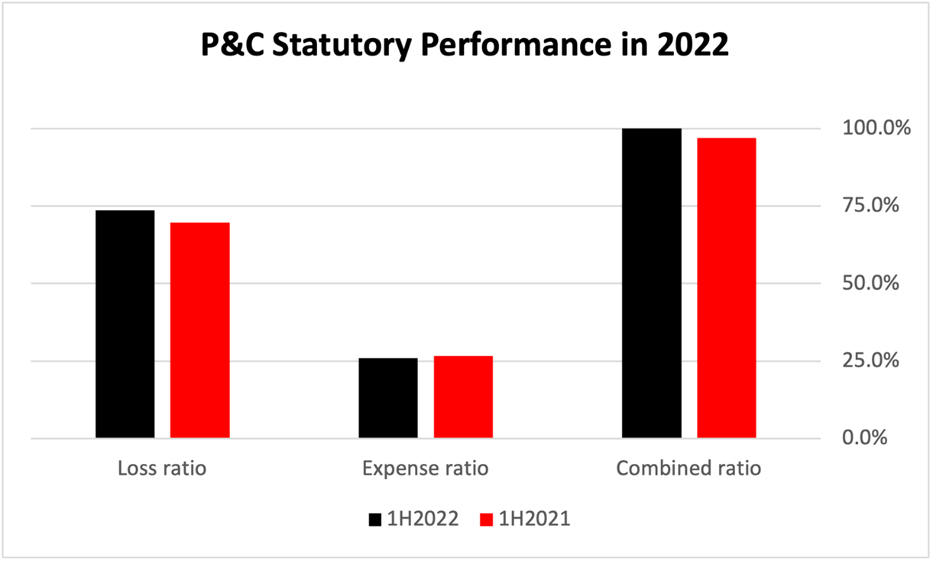

In the meantime, non-admitted insurers must focus on maintaining their financial performance, especially in underwriting profitability. Despite growth in property and casualty net premiums written, insurers in the first of half of 2022 reported a higher combined ratio and reductions in net income and surplus, according to Fitch Ratings. Data from Fitch show loss ratios rising for P&C insurers in the first half of 2022. The direct loss ratio in personal auto, for example, rose to 75%, an increase of 13 percentage points from a year earlier. In addition to higher claims costs for replacement parts and repairs, trends in litigation and settlements have boosted insurers’ costs in bodily injury claims.

Source: Fitch Ratings

Gain Specialized Resources for Surplus Lines

Even when premium volume increases, surplus lines businesses can see their margins narrow. During difficult economic conditions, the non-admitted market needs robust, streamlined, and cost-effective operational solutions more than ever. ReSource Pro offers a broad set of resources to assist surplus lines organizations, from turnkey licensing compliance to premium tax filings. For more information, visit our Compliance page.