Independent Insurance Agents: Are They Going Extinct?

This post won the Award of Excellence for a single blog post from IMCA.

Scott Wilson has 20+ years of experience in the insurance industry. He’s held various sales and leadership roles for one of the world’s largest retail brokers and was a founding member of his family’s insurance agency in Phoenix, AZ.

Is Extinction Nigh?

You’ve read the stats about the surge of M&A activity happening among insurance agencies. After last year’s record 601 agency mergers and acquisitions, 2019 is already galloping past 2018’s pace, according to The Hales Report.

Does this signal the extinction of the independent agency? The end of the relationship-centric, middle-class heart of the American insurance industry? Are we in the last days of a dinosaur?

Hardly. For every acquisition, there is a new agency sprouting up, led by a new generation. Reagan Consulting estimates that agency regeneration is currently more than 1-to-1. While those concerned about the talent crisis love to throw out stats about only 4% of millennials being interested in the insurance industry, it looks like actions speak louder than words.

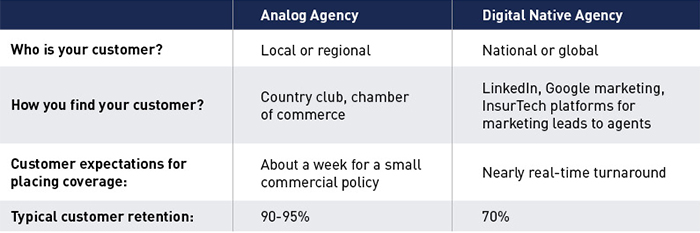

Comparing the independent agencies of yesterday to today, what differences can we see? I notice that many of the newer ones have the benefit of being digital from day one. This means no filing cabinets or fax machines to cope with—they start out efficient, with no legacy of paper to work around. Using all digital documents, these new agencies can also extract more data and fuel decisions with the insights gained from them.

The Good and the Bad of Today’s Agencies

When I started in the business 20 years ago, I was working with a brick and mortar agency and using a DOS system. I generated business through the good old boys and girls network: country clubs, chamber of commerce meetings, and different activities around town. You kept clients much longer then because you had made a personal connection. Today’s brokers have a much greater reach, with more lines of business across more terrain—national and even global reach is attainable for smaller agencies.

Make the most of your data with ReSource Pro’s Analytics Suite.

However, low-touch customer relationships are challenging in their own regard. Your business becomes about your price—not your service. People can hop online and get another service quote quickly. Amid this commoditization, how can the new breed of agents stand out?

How to Stand Out in 2020 and Beyond

Without the human interaction of yesterday’s agency, how do you retain business over the long term? Sure, there are plenty of tools for finding new business from Google Marketing, Lead Generation Services and InsurTech players, but new business costs 5 times more than keeping business.

For agencies old, new, and in-between, here are some ways to succeed in the new insurance landscape:

-

Offer services behind coverage.

Brokers that sell nothing more than conventional policies will have little reason to connect with customers outside of the renewal period. Loyalty is hard to come by when you interact once a year or less, and harder even for P&C, according to Bain & Company research. One way to deepen the relationship is through non-insurance services. For example, you could bundle a commercial package with a consulting service like workplace safety, loss control and prevention, or a warranty product for goods and services. Or for personal insurance, it could be to add on identity theft protection, home security, and financial planning. Your customers will start to think of you for an ecosystem of products that bring peace of mind, not just for the dollar amount of one product.

How this helps the agency: More renewals, less chasing new business, more revenue per account

-

Keep low-friction interactions low-friction.

Customers are increasingly comfortable communicating with chatbots. Chatbots can handle simple requests like endorsements, evidence of insurance, invoicing and policy documents. To have the capacity to serve insureds in a more meaningful way like bundling services, you’re going to need more time, and a great way to find it is to divert these easy asks to a no-touch chatbot.

How this helps the agency: More time for consultative conversations, faster customer service

-

You’re Digital – so what?

Robotic Process Automation, artificial intelligence, machine learning, block chain—which to invest in? This is a great question that agency heads should be looking at. However, the exciting technology of today will become industry standard within five years. Are you prepared to make significant investments in technologies that won’t be your main differentiator?

Another way out of this issue is to partner with an organization that always provides the latest technology baked into its solutions. That’s where ReSource Pro comes in. If you’re interested in learning about which of our digital capabilities could help strengthen your agency, contact us.