“I think quite a lot of damage has been done to the reputation of chatbots with the ‘bots of old, but the new wave provide far more depth than ever before. The ability to kick off automated workflows, drive efficiency gains through better understanding of customer interactions and online assistance, whilst providing seamless transition to a customer service rep when necessary, suggest a future far more glorious for the much belied chatbot.“

Christopher Frankland, Head of Technology Solutions Lab, ReSource Pro

Chatbots for a long time have existed to amuse, frustrate and at times entertain (albeit unintentionally). The term “ChatterBot” was originally coined by Michael Mauldin (creator of the first Verbot, Julia) in 1994 to describe conversational programs (thanks, Wikipedia). From the lofty origins of Verbot, the humble chatbot has become a bit of a loner, the last bastion of customer support. This, of course, is a real shame and a glaring missed opportunity for companies who are looking to engage effectively with customers to provide some level of assistance for simple questions and tasks.

Chatbots Reborn

With the technology in place to support chatbots (AI, machine learning and automation) evolving at a frenetic pace, the chatbot is rising from the ashes with a newly defined purpose.

Trusted Adviser

Finally, the humble chatbot is growing up and assuming the role of trusted adviser. They can be the first course of action for a frustrated customer, helping to get a quick answer to a straightforward question, or assisting in navigating a complicated form. The end goal is quite simple really: deliver a frictionless and delightful experience for the customer; and in turn, free up the time of the customer service team to focus on more complex tasks and requests.

The Future

So what does the future hold? Machine Learning. AI. Analytics Driven Intelligent Workflow. API Integration. These are all capabilities that, when combined, can deliver an outstanding customer experience.

“Well-designed, emotionally intelligent chatbots enable insurance companies to give increasingly personal digital customer service. The chatbot not only replaces the form with an engaging, easy to use interface, it also arms the insurer with more understanding of who their customers are, and may even help guide the evolution of the insurance product itself.” – Alberto Chierici, CPO and co-founder at SPIXII

The API Economy + Cognitive Capabilities

Cognitive APIs and services are creating new and exciting opportunities to reimagine workflow and process automation through a digital lens. The ability to intelligently answer routine questions and interpret customer intent impacts not only the customer experience, but can also help drive operational efficiency gains.

From an account manager point of view, having a chatbot or an intelligent virtual assistant at the ready, can help provide a deep level of insight when speaking with a customer. Delivering sophisticated solutions that integrate complex workflow, whilst accurately interpreting customer emotion, can generate valuable cross-selling opportunities.

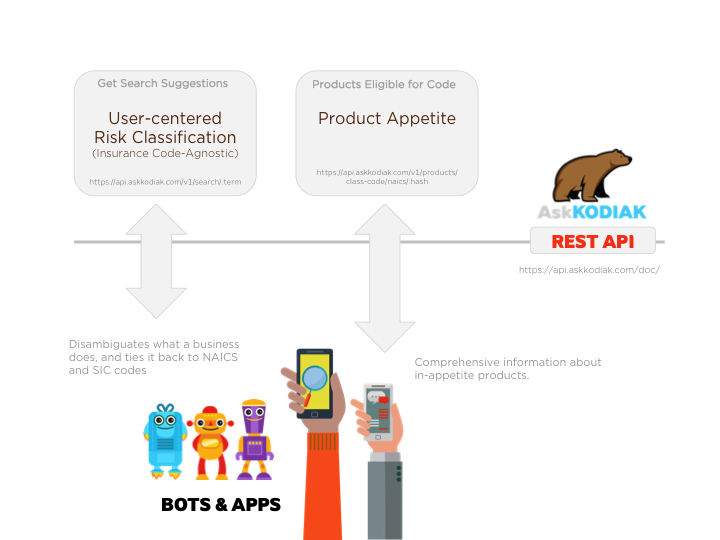

Workflow integration with third party APIs can also help yield valuable information and feedback for product inquiries. Kodiak, for example, has a product that provides insight around Product Appetite and User-centered Risk Classification.

In Commercial P&C, two of the biggest broker challenges are risk classification and market selection. Instead of having to guess which class code to use with a given carrier or ask a co-worker who has appetite for the risk, imagine instead having access to this sort of information in real time, while on the phone with a customer. Chatbots, APIs and the technology driving them are opening up a whole new realm of possibilities when it comes to employee and customer engagement.

End to End Process

We’ve only scratched the surface of chatbots and their potential. When you start to think about your end-to-end processes, and how a chatbot might be leveraged to invoke a task or workflow, there really isn’t a limit to what you can accomplish. Pair automation and analytics with human touch and insight, and you’ll start to see a powerful model emerge.

What is the driver here? Faster, cheaper and more consistent decision making, driven by a combination of streamlined and frictionless workflow and intelligent AI – all at scale. Of course, this is not the savior for all workflow and process. P&C can be notoriously complex, and there will always be a need for the sort of bespoke guidance that only a human can provide. The fact is, technology can and should be leveraged to help us make better and more education decisions to help our customers.

“86% of consumers will pay more for a better customer experience.” – Annual Customer Experience Impact (CEI) Report

Innovation Technology Lab

Here at the Innovation Technology Lab at ReSource Pro’s Insurance Experience Center, we are constantly pushing ourselves to rethink the Insured Experience through the digital lens.

What are the tools and features that will help enable policy holders to make better and more informed decisions?

How can we leverage people, process and technology to deliver an insured customer experience that a) builds loyalty and increases retention rates and b) eliminates inefficiencies that hamper the overall customer experience?

Digital has a key role to play in the Insurance Experience of the Future and chatbots are finally starting to hold their own as key participants in the exciting journey ahead.